Just like other business, NorthWestern Energy pays its share of taxes and fees. These funds help support schools and local government agencies.

NorthWestern Energy invests significantly in critical electric and natural gas infrastructure and this impacts property taxes. Therefore, we work hard to manage our tax burden for the benefit of our customers.

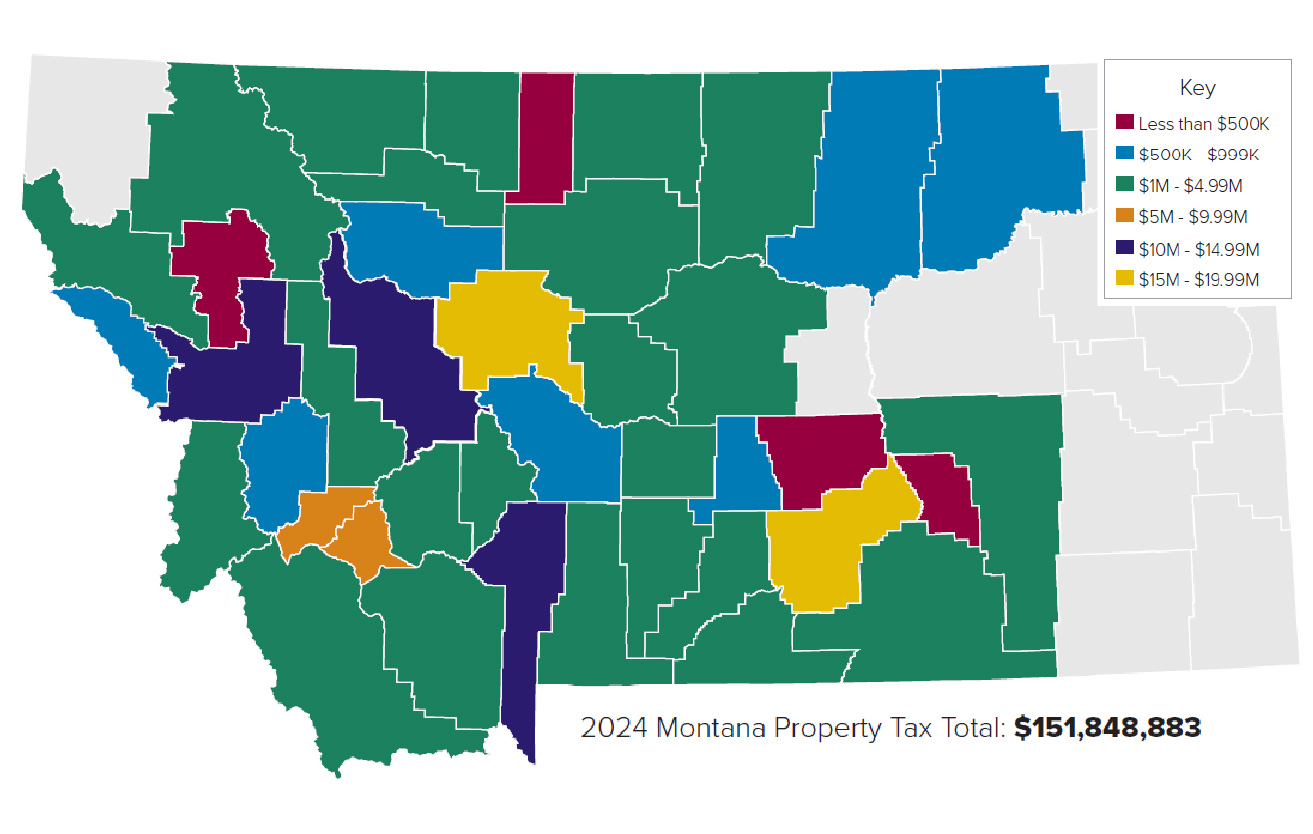

Montana

In 2024, NorthWestern Energy paid nearly $152 million in Montana property taxes.

In Montana, property taxes are a significant part of the funding for schools, fire departments, law enforcement agencies and many other vital services.

| 2024 Montana Property Tax | ||||

|---|---|---|---|---|

| County | Total Tax | |||

| Yellowstone | $17,983,225.84 | |||

| Cascade | $17,618,030.24 | |||

| Missoula | $14,748,957.23 | |||

| Gallatin | $13,620,758.99 | |||

| Lewis and Clark | $13,351,675.61 | |||

| Butte-Silver Bow | $9,346,907.35 | |||

| Anaconda-Deer Lodge | $5,556,062.70 | |||

| Rosebud | $4,943,860.24 | |||

| Glacier | $4,363,408.24 | |||

| Sanders | $3,481,907.31 | |||

| Carbon | $3,305,082.53 | |||

| Ravalli | $3,272,164.77 | |||

| Stillwater | $3,050,932.63 | |||

| Hill | $2,786,195.47 | |||

| Park | $2,455,266.8 | |||

| Big Horn | $2,166,579.68 | |||

| Flathead | $2,147,061.17 | |||

| Powell | $2,124,061.28 | |||

| Jefferson | $2,110,937.79 | |||

| Toole | $2,095,306.60 | |||

| Madison | $1,869,972.47 | |||

| Blaine | $1,805,693.70 | |||

| Fergus | $1,446,928.03 | |||

| Beaverhead | $1,432,850.47 | |||

| Broadwater | $1,345,504.30 | |||

| Wheatland | $1,218,429.02 | |||

| Sweet Grass | $1,100,290.19 | |||

| Chouteau | $1,056,138.13 | |||

| Judith Basin | $1,042,517.30 | |||

| Pondera | $1,024,849.86 | |||

| Granite | $987,623.16 | |||

| Mineral | $921,116.85 | |||

| Teton | $878,849.80 | |||

| Meagher | $762,112.67 | |||

| Valley | $745,288.42 | |||

| Phillips | $634,149.08 | |||

| Golden Valley | $524,883.35 | |||

| Lake | $461,044.89 | |||

| Musselshell | $424,980.44 | |||

| Liberty | $415,847.63 | |||

| Treasure | $136,599.91 | |||

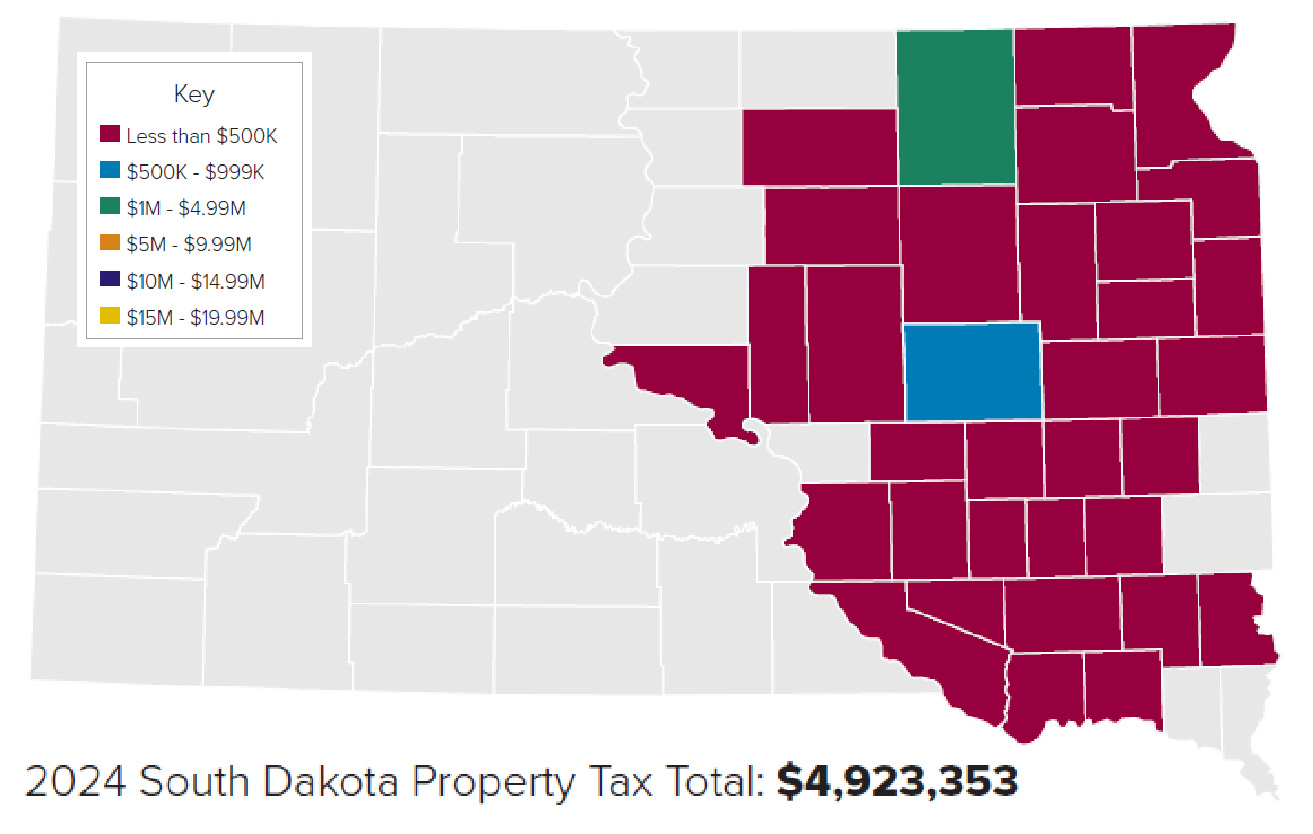

South Dakota

For tax year 2024, we paid $4.9 million in South Dakota property and wind taxes. Property taxes are used in South Dakota to fund county and municipal governments and schools.

| 2024 South Dakota Property Tax | ||||

|---|---|---|---|---|

| County | Total Tax | |||

| Brown | $1,100,335.90 | |||

| Beadle | $912,454.48 | |||

| Yankton | $460,770.48 | |||

| Davison | $422,946.06 | |||

| Grant | $383,369.24 | |||

| Hutchinson | $173,741.48 | |||

| Brookings | $136,129.62 | |||

| Charles Mix | $115,452.26 | |||

| Brule | $109,472.44 | |||

| Bon Homme | $87,864.00 | |||

| Day | $88,742.50 | |||

| Clark | $83,673.38 | |||

| Lake | $65,935.12 | |||

| Turner | $59,705.10 | |||

| Lincoln | $56,372.80 | |||

| Sanborn | $49,484.81 | |||

| Douglas | $47,455.20 | |||

| Faulk | $44,135.86 | |||

| Hyde | $41,172.60 | |||

| Hamlin | $38,684.33 | |||

| Aurora | $38,100.98 | |||

| Deuel | $37,755.44 | |||

| Hand | $23,147.01 | |||

| Kingsbury | $26,039.41 | |||

| Codington | $30,157.99 | |||

| Hanson | $18,316.71 | |||

| Hughes | $10,172.54 | |||

| Jerauld | $9,538.29 | |||

| McCook | $8,961.74 | |||

| Miner | $7,578.74 | |||

| Roberts | $963.38 | |||

| Marshall | $555.80 | |||

| Grand Total: $4,923,353.72 | ||||

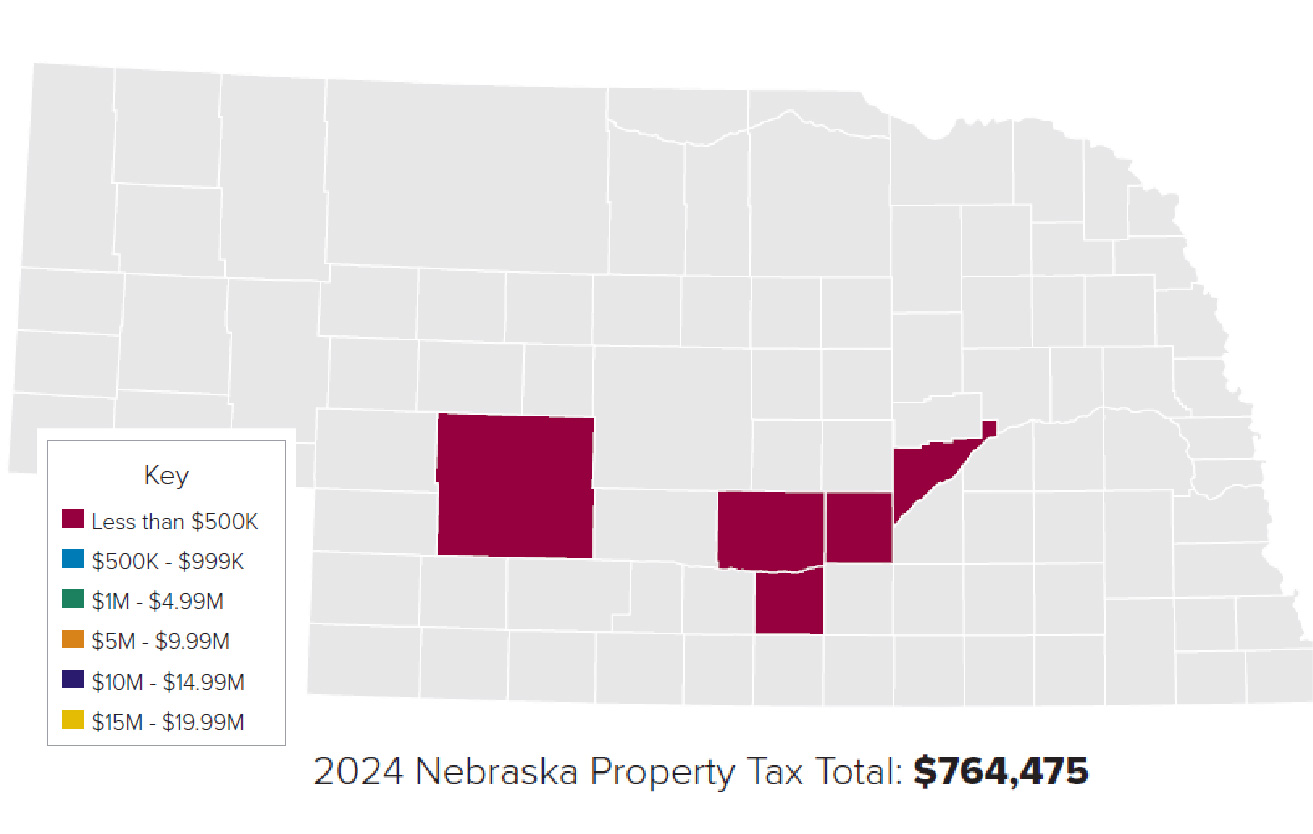

Nebraska

For tax year 2024, we paid nearly $765,000 in Nebraska property taxes. In Nebraska, property taxes fund schools, county and city governments, natural resources and more.

| 2024 Nebraska Property Tax | ||||

|---|---|---|---|---|

| County | Total Tax | |||

| Hall | $338,770.86 | |||

| Lincoln | $220,820.98 | |||

| Buffalo | $201,414.54 | |||

| Kearney | $2,404.66 | |||

| Merrick | $1,064.70 | |||

| Grand Total: $764,475.74 | ||||