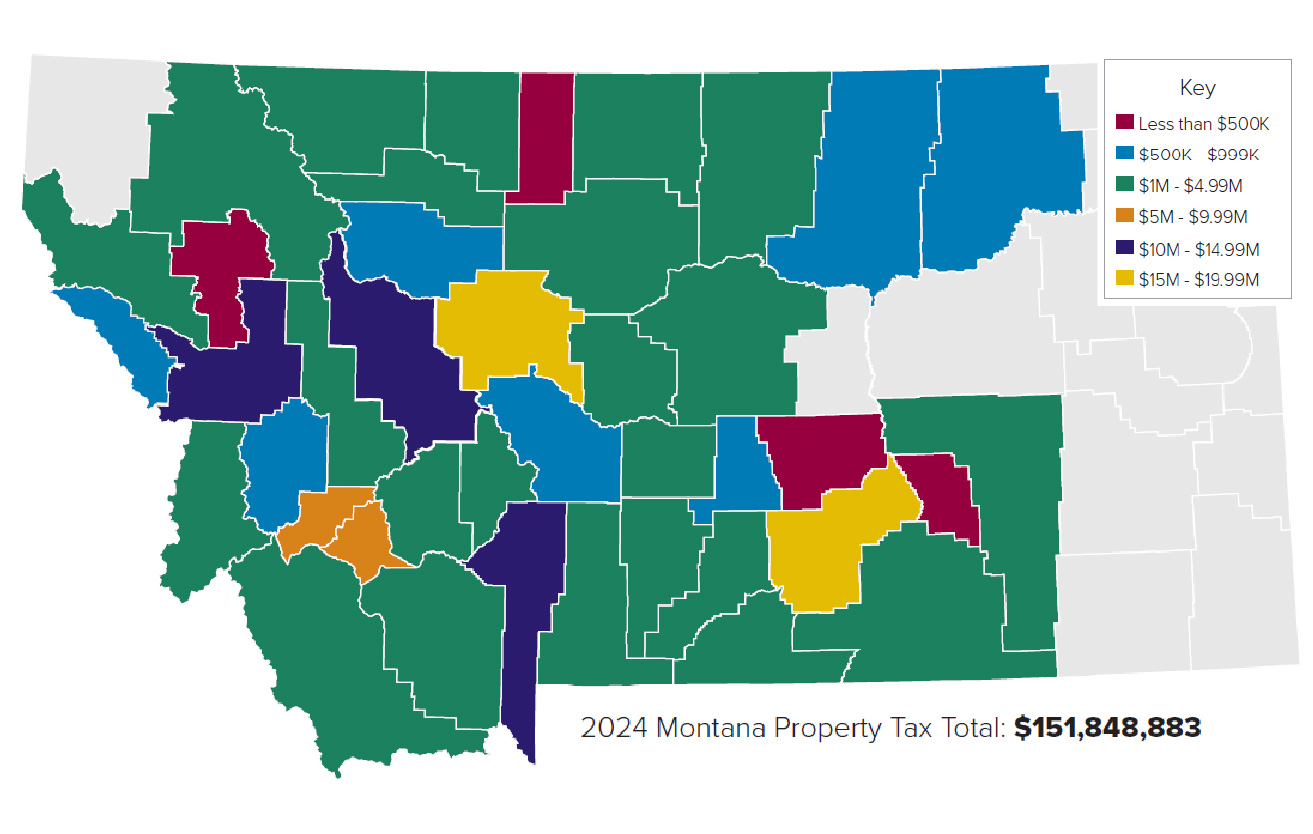

Montana

In 2024, NorthWestern Energy paid nearly $152 million in Montana property taxes.

In Montana, property taxes are a significant part of the funding for schools, fire departments, law enforcement agencies and many other vital services.

| 2024 Montana Property Tax | ||||

|---|---|---|---|---|

| County | Total Tax | |||

| Yellowstone | $17,983,225.84 | |||

| Cascade | $17,618,030.24 | |||

| Missoula | $14,748,957.23 | |||

| Gallatin | $13,620,758.99 | |||

| Lewis and Clark | $13,351,675.61 | |||

| Butte-Silver Bow | $9,346,907.35 | |||

| Anaconda-Deer Lodge | $5,556,062.70 | |||

| Rosebud | $4,943,860.24 | |||

| Glacier | $4,363,408.24 | |||

| Sanders | $3,481,907.31 | |||

| Carbon | $3,305,082.53 | |||

| Ravalli | $3,272,164.77 | |||

| Stillwater | $3,050,932.63 | |||

| Hill | $2,786,195.47 | |||

| Park | $2,455,266.8 | |||

| Big Horn | $2,166,579.68 | |||

| Flathead | $2,147,061.17 | |||

| Powell | $2,124,061.28 | |||

| Jefferson | $2,110,937.79 | |||

| Toole | $2,095,306.60 | |||

| Madison | $1,869,972.47 | |||

| Blaine | $1,805,693.70 | |||

| Fergus | $1,446,928.03 | |||

| Beaverhead | $1,432,850.47 | |||

| Broadwater | $1,345,504.30 | |||

| Wheatland | $1,218,429.02 | |||

| Sweet Grass | $1,100,290.19 | |||

| Chouteau | $1,056,138.13 | |||

| Judith Basin | $1,042,517.30 | |||

| Pondera | $1,024,849.86 | |||

| Granite | $987,623.16 | |||

| Mineral | $921,116.85 | |||

| Teton | $878,849.80 | |||

| Meagher | $762,112.67 | |||

| Valley | $745,288.42 | |||

| Phillips | $634,149.08 | |||

| Golden Valley | $524,883.35 | |||

| Lake | $461,044.89 | |||

| Musselshell | $424,980.44 | |||

| Liberty | $415,847.63 | |||

| Treasure | $136,599.91 | |||

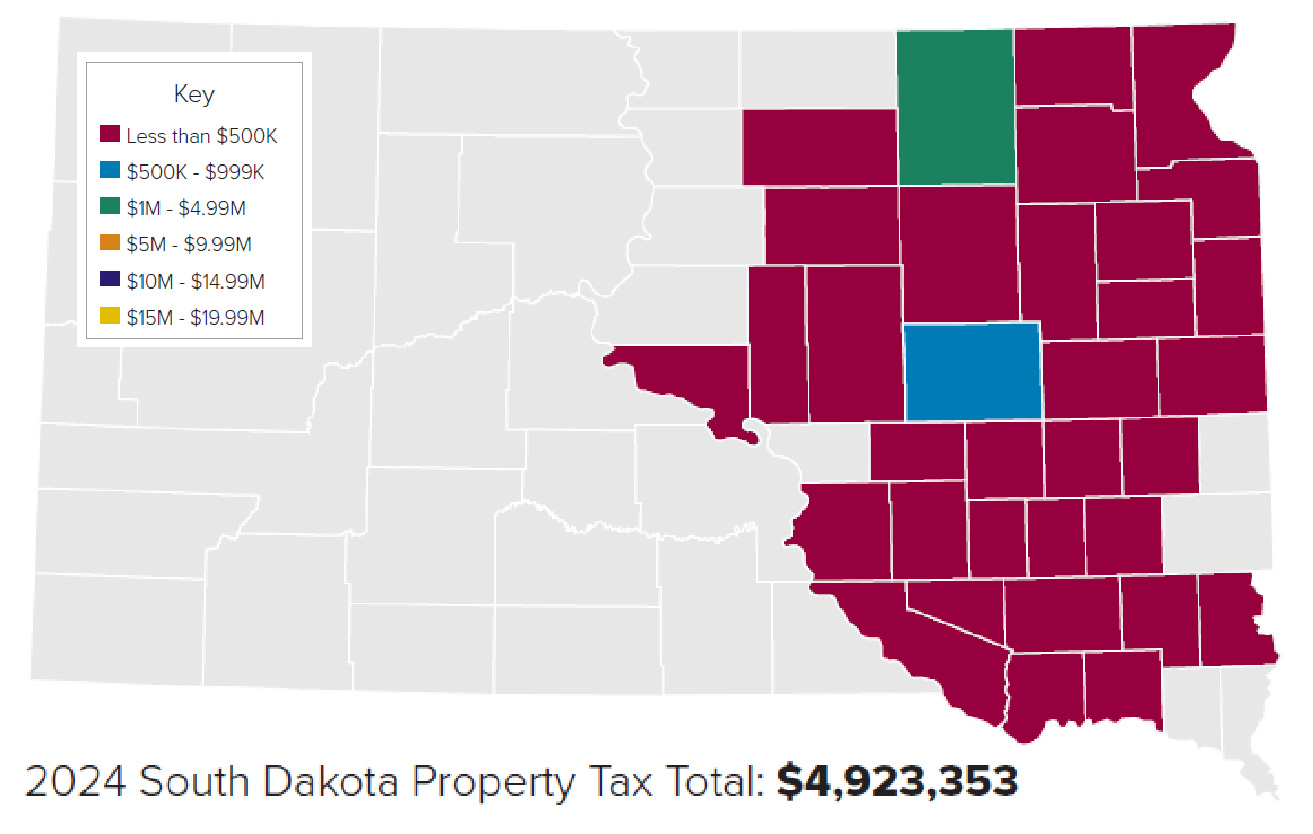

South Dakota

For tax year 2024, we paid $4.9 million in South Dakota property and wind taxes. Property taxes are used in South Dakota to fund county and municipal governments and schools.

| 2024 South Dakota Property Tax | ||||

|---|---|---|---|---|

| County | Total Tax | |||

| Brown | $1,100,335.90 | |||

| Beadle | $912,454.48 | |||

| Yankton | $460,770.48 | |||

| Davison | $422,946.06 | |||

| Grant | $383,369.24 | |||

| Hutchinson | $173,741.48 | |||

| Brookings | $136,129.62 | |||

| Charles Mix | $115,452.26 | |||

| Brule | $109,472.44 | |||

| Bon Homme | $87,864.00 | |||

| Day | $88,742.50 | |||

| Clark | $83,673.38 | |||

| Lake | $65,935.12 | |||

| Turner | $59,705.10 | |||

| Lincoln | $56,372.80 | |||

| Sanborn | $49,484.81 | |||

| Douglas | $47,455.20 | |||

| Faulk | $44,135.86 | |||

| Hyde | $41,172.60 | |||

| Hamlin | $38,684.33 | |||

| Aurora | $38,100.98 | |||

| Deuel | $37,755.44 | |||

| Hand | $23,147.01 | |||

| Kingsbury | $26,039.41 | |||

| Codington | $30,157.99 | |||

| Hanson | $18,316.71 | |||

| Hughes | $10,172.54 | |||

| Jerauld | $9,538.29 | |||

| McCook | $8,961.74 | |||

| Miner | $7,578.74 | |||

| Roberts | $963.38 | |||

| Marshall | $555.80 | |||

| Grand Total: $4,923,353.72 | ||||

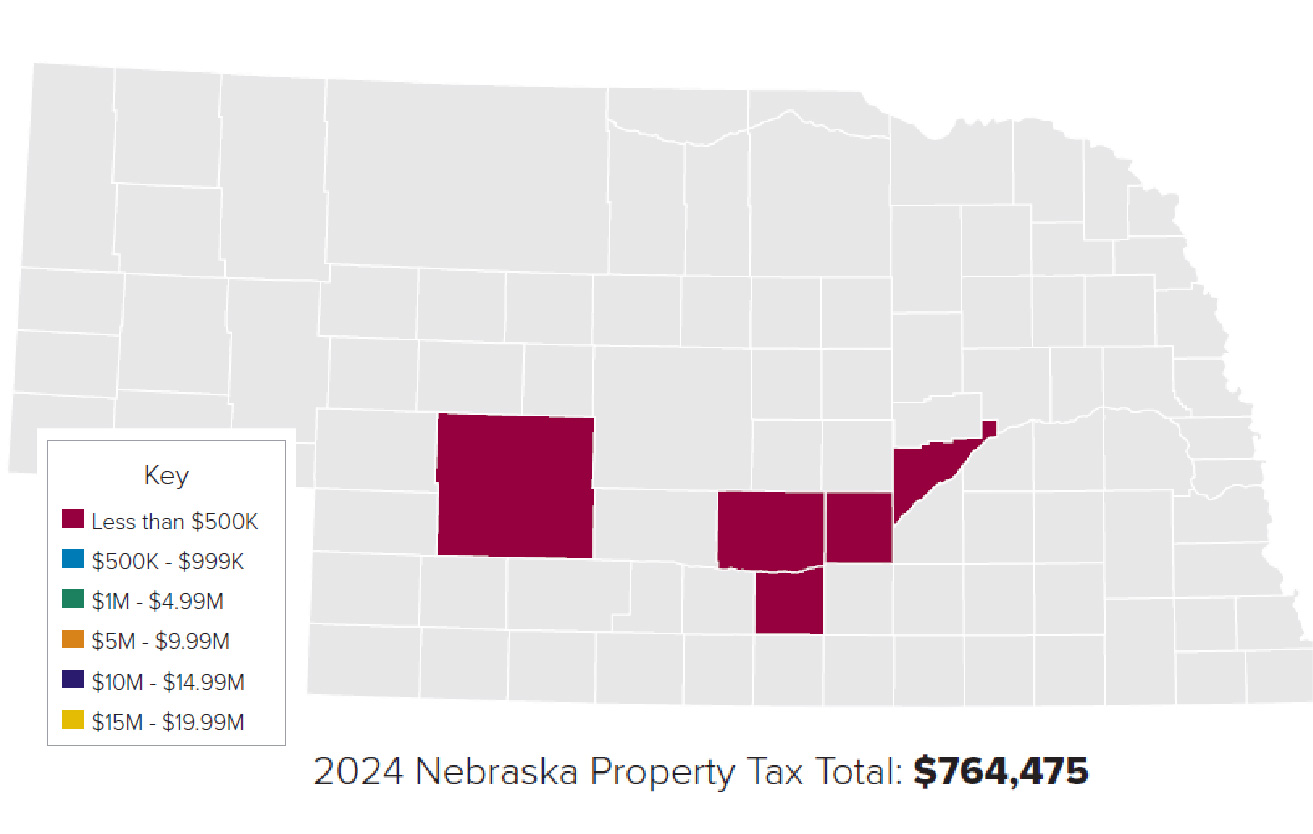

Nebraska

| 2024 Nebraska Property Tax | ||||

|---|---|---|---|---|

| County | Total Tax | |||

| Hall | $338,770.86 | |||

| Lincoln | $220,820.98 | |||

| Buffalo | $201,414.54 | |||

| Kearney | $2,404.66 | |||

| Merrick | $1,064.70 | |||

| Grand Total: $764,475.74 | ||||