Non-communicating meters

How do I read my non-communicating meter?

Click the links below for instructions on how to read your meter, self-read dates and a postcard you can use to submit your meter readings.

Gas meter

Gas meter

Natural gas dials represent the amount of natural gas measured in volumes of hundreds of cubic feet (ccf).

A gas meter is driven by the force of the moving gas in the pipe, and also turns faster as the flow increases. Each time the dial with the lower value makes one complete revolution, the pointer on the next higher value dial moves ahead one digit.

To read your meter:

- Be at eye level of the dials.

- Mark the dials from left to right.

- Take note of the direction of the arrows on the display – the pointer of adjacent dials turn in opposite directions to each other.

- Draw the pointer on the dials as displayed on your gas meter.

- When the pointer on the dial is between two numbers, record the lower number.

- If the pointer is between 9 and 0, 9 is the lower number.

- When the pointer is directly on the number, look at the dial to its right:

- Has the dial on the right has passed 0, yes, use the number that the pointer is on.

- The dial on the right has not passed "0," use the number less than what the pointer is on.

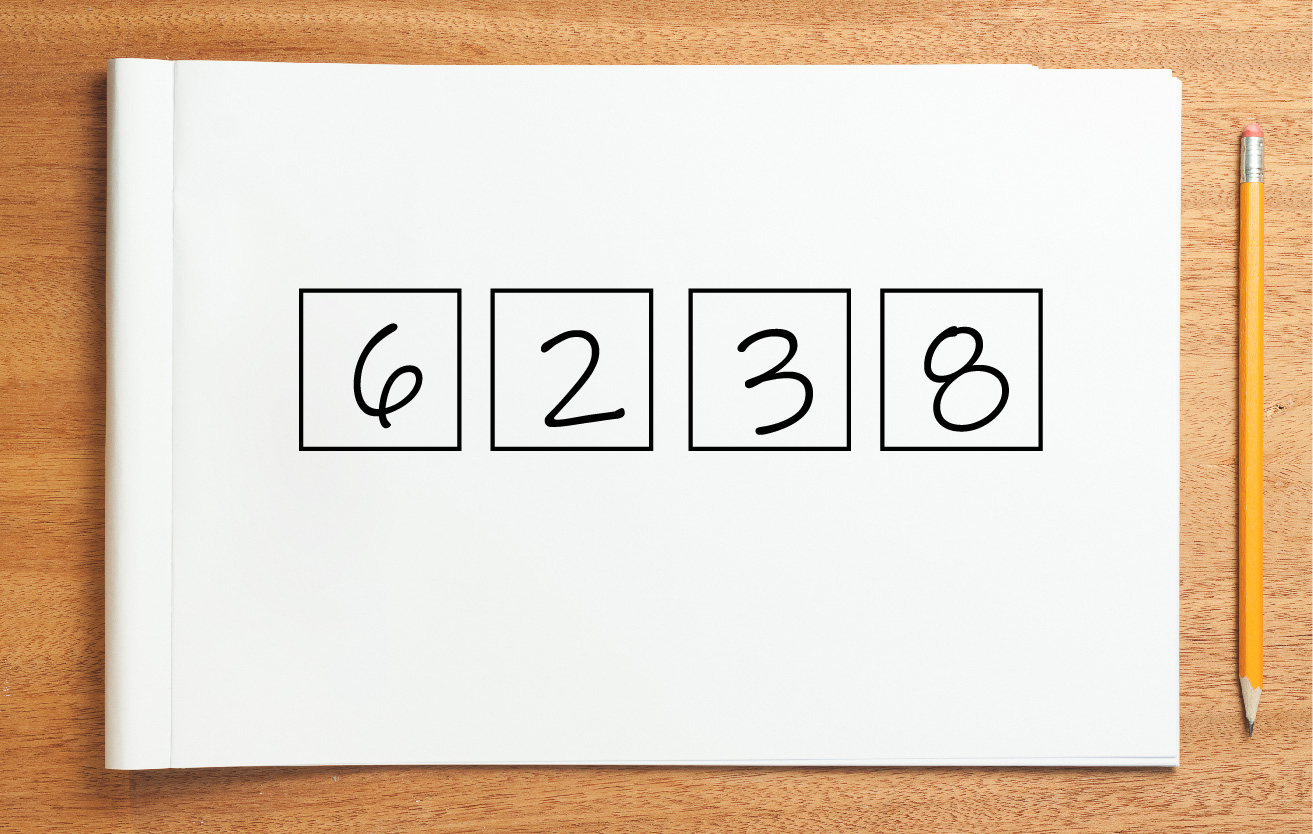

Example:

In the example below, the reading is: 6 2 3 8

Electric meter

Electric meter

The basic unit of measure of electric power is the watt. One thousand watts is called a kilowatt.

When you use one thousand watts of power in one hour, you have used one kilowatt (kWh).

We bill you by the kWh. Your electric meter is a digital meter that has an electronic display that displays the current reading, like a digital clock.

When reading an electric meter, write down the numbers as shown on the meter.

Example:

In the example below, the reading is: 0 0 2 1 0 8

When submitting your meter reads, please be ready with your account number, your service address, your meter read(s) and the date you read your meter(s).

Options to submit your meter reads:

- Submit online in My Energy Account

- Call (888) 467-2669; M-F 7 a.m.-6 p.m.

- Mail the meter reading card to us at:

Communicating meters

How do I read my communicating advanced meter?

Click the links below for instructions on how to read your meter, self-read dates and a postcard you can use to submit your meter readings.

Advanced Meter FAQs

What is the advanced meter project timeline in Montana?

NorthWestern Energy began installation in Montana in 2021. Here is a list of approximate dates for the Montana Meter Upgrade project by area:

- Missoula Division: completed August 2022

- Butte Division: completed June 2022

- Bozeman Division: completed May 2024

- Billings Division: completed October 2024

- Lewistown District: completed October 2024

- Havre District: completed November 2024

- Helena Division: June 2024 – May 2025

- Great Falls Division: August 2024 – May 2025

Will I have to pay for the meter?

Who will change my meter?

NorthWestern Energy contracted with Tru-Check to install the new digital meters, the same company that installed the first generation, one-way communication digital meters in 1998 that are in use today.

Tru-Check technicians will wear apparel with the Tru-Check logo and will carry a NorthWestern Energy contractor identification badge.

When will the meters be installed and do I need to be home?

Most of the installations will occur Monday through Friday during business hours, though there will be cases when evening or weekend installations may be necessary. Customers don't need to be home.

A door hanger will let residents know their upgrade was successful. If the technician cannot perform the upgrade, a door hanger will be left with instructions to call to make an appointment.

If you are both an electric and natural gas NorthWestern Energy customer, the new electric meter will be installed first and the new gas module will be installed during a follow-up visit to your home or business in about eight weeks.

What happens to the meter on my home or business now?

Are radio frequency (RF) emissions coming from the meters and modules?

Yes. The Federal Communications Commission (FCC) regulates the safety limits for all RF emissions, and smart meter and module emissions make up a small portion of the limit. The RF emissions of the one-way communication meters in use now and the two-way communication meters that are being installed for this technology upgrade are both approved by the FCC. Radio frequency emissions are also produced by common household devices such as microwaves, baby monitors and TVs.

Is customer information protected?

Yes. Customer privacy and security are NorthWestern Energy priorities. The company’s strict security standards have contributed to protecting the energy grid and customer privacy for years. The meters do not collect, store or transmit any personally identifiable information.

The meters measure total energy and cannot differentiate energy usage by appliance or anything else within a home or business. The transmitted energy use information is encrypted.What if I don’t want an upgraded meter?

Customers who want to keep their existing meters can call NorthWestern at 888-467-2669 or email NorthWesternEnergyMeters@northwestern.com to be added to the bypass list. Customers who previously requested an opt out do not need to contact NorthWestern again to be bypassed and keep their meters.

NorthWestern will be reaching out to customers who received an advanced meter despite their request to opt out. For those who still wish to opt-out, NorthWestern will ensure that the advanced meter is removed and replaced with a meter similar to the one that was there before. Customers will not be charged for this service.

Customers who have questions about the advanced meter opt-out program can contact NorthWestern at 888-467-2669

or the Montana Public Service Commission at 1-800-646-6150 or pschelp@mt.gov.

Black Hills Corp. and NorthWestern Energy to Combine in All-Stock Merger to Create a Premier Regional Regulated Electric and Natural Gas Utility Company

Date: Aug 18, 2025

TYPE: News

Categories: Investors, Investors

Increased scale and business line diversity to result in a stronger, more resilient platform to safely, reliably, and cost-effectively meet customers’ rising energy needs

Merger expected to be accretive to each company’s EPS in the first year following the close of transaction

Combined company supports an increased long-term EPS target growth rate of 5% to 7%

Contiguous service territory with attractive growth profile expected to provide additional investment opportunities beyond each company’s current capital investment plan

Strong and predictable earnings and cash flows with more efficient access to capital to be credit-enhancing and support a high-quality credit profile, an enhanced ability to invest in critical infrastructure, and a strong and growing dividend

Veteran leadership team and complementary cultures with shared commitments to safety, reliability, and exceptional customer service provided by a highly skilled workforce

Companies to host joint conference call today at 6:30 a.m. MDT / 7:30 a.m. CDT / 8:30 a.m. EDT

RAPID CITY, SD and BUTTE, MT / SIOUX FALLS, SD — Aug. 19, 2025 – Black Hills Corp. (NYSE: BKH) and NorthWestern Energy Group, Inc. d/b/a NorthWestern Energy (Nasdaq: NWE) today announced that each company’s board of directors has unanimously approved a definitive agreement to combine in an all-stock, tax-free merger that will create a premier regional regulated electric and natural gas utility company with a pro forma market capitalization of approximately $7.8 billion and a combined enterprise value of $15.4 billion, based on each company’s closing stock price as of August 18, 2025.

Black Hills Corp. President and CEO, Linn Evans said, “We are excited to bring our two highly complementary companies together to create significant long-term value for customers, employees, shareholders, and the communities we serve. Our future success will be driven equally by the people, assets, and capabilities of both organizations. The combined company will have greater scale and financial strength to consistently deliver for customers across our service territories and invest at the pace and scale that today’s energy transformation demands. Our vision is to be the energy partner of choice for our customers, communities, and investors, and this merger will accelerate our ability to achieve this goal.

NorthWestern Energy President and CEO, Brian Bird said, “Our merger with Black Hills will create a premier regional regulated utility company with a larger, more resilient platform consistent with mid-cap peers. Together, we will be better positioned to meet rising demand, accelerate investment in energy and grid infrastructure, and support customers and communities through a rapidly evolving energy landscape. NorthWestern and Black Hills are best-in-class operators, and we are confident that our closely aligned cultures and skilled workforces will enable us to successfully bring the companies together. We will remain a trusted energy partner to our customers and look forward to building a brighter future for the people, businesses, and communities we are privileged to serve.”

Under the terms of the agreement, NorthWestern shareholders will receive a fixed exchange ratio of 0.98 shares of Black Hills for each share of NorthWestern they own at the close of the transaction. The exchange ratio implies an approximately 4% premium based on the volume weighted average price of each company’s common stock since Black Hills and NorthWestern began discussing transaction terms in March 2025. Black Hills shareholders will continue to hold the same number of shares of the combined company that they hold of Black Hills immediately prior to the closing of the transaction. Upon completion of the merger, Black Hills shareholders will own approximately 56% and NorthWestern shareholders will own approximately 44% of the combined company on a fully diluted basis.

Compelling Strategic and Financial Rationale

- Pure-play, regulated, vertically integrated utility with enhanced scale and diverse customer and fuel mix. The combined company will serve approximately 2.1 million customers across eight contiguous states -- Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Its electric utility will serve approximately 700,000 customers and operate approximately 38,000 miles of electric lines and approximately 2.9 gigawatts of owned generation capacity fueled by a mix of thermal, hydro, and wind. Its natural gas utility will serve approximately 1.4 million customers and operate approximately 59,000 miles of natural gas lines. Over time, this increased scale is expected to drive operating and cost efficiencies across the combined enterprise.

- Doubles rate bases and provides increased investment opportunities to meet rising energy demand, while ensuring competitive rates. The combination will double the size of each company’s rate base to a total of approximately $11.4 billion, with approximately $7.0 billion and $4.4 billion for electric and natural gas, respectively. Combined, the companies’ current investment plans from 2025 to 2029 exceed $7 billion and will be focused on building new electric and natural gas critical infrastructure to meet rising energy demand and advancing energy resilience in the regions where the combined company operates, while ensuring long-term competitive rates for customers. This level of investment is expected to increase following the combination as the combined company leverages its enhanced resources to make strategic investments that foster economic development in its expansive territories, including addressing the growing demand from data centers.

- Constructive and diversified regulatory environment. Rate structures for the electric and natural gas businesses have supportive regulatory mechanisms that promote efficient recovery of capital and minimize regulatory lag. No single jurisdiction will represent greater than 33% of the combined business.

- Increases long-term EPS target growth rate and accretive to each company. The combined company supports a long-term target EPS growth rate of 5% to 7%, greater than both Black Hills and NorthWestern on a standalone basis. The combination is expected to be accretive to each company’s EPS in the first year following the close of the transaction.

- Strong and predictable cash flows and high-quality investment-grade profile. The combined company is expected to have substantial cash flows to support a customer-focused capital investment program and an ongoing strong investment-grade credit quality.

- Strong and growing dividend. Both companies expect to maintain their existing dividend policies until the merger transaction is completed. Upon closing of the transaction and subject to market conditions and approval by the combined company’s board of directors, the combined company is expected to establish a dividend policy reflecting a prudent balance across return of capital, investing in growth, and balance sheet strength.

- Benefits that reach more customers and deliver more value. Both companies are recognized for their strong commitments to reliability and customer service. Together, customers will benefit from extending shared best practices across the combined service territory. Over time, the combined company is expected to benefit from process improvements, shared systems, and coordinated operations. The resulting operating and cost optimization will support continued investment in safety, reliability, and customer service, and deliver long-term value for customers.

- Employer of choice with a highly skilled workforce. Led by industry veterans, the combined company will bring together talented teams that are focused on delivering safe, reliable, and cost-effective energy. As a larger and stronger organization, the combined company is expected to have an enhanced ability to retain, attract, and develop employees, including opportunities for career advancement, and will continue to be staffed and structured to meet the needs of its growing customer base. Consistent with each company’s goal of being an employer of choice, the combined company expects to continue providing competitive compensation and comprehensive benefits programs to employees.

- Ongoing community support. The combined company will continue to be an active part of the communities we serve as we support customers with a local workforce of highly skilled, passionate, and dedicated employees. In addition to maintaining a strong local workforce, both companies have long-standing reputations as excellent corporate citizens, and the combined company will maintain support for civic and philanthropic organizations across its combined service area.

- Advancing a clean energy future. The combined company will continue to work towards long-term emissions reduction as part of broader affordability, reliability, and sustainability commitments through investments in renewable energy sources, technological advancements, and modernizing infrastructure, among other initiatives.

The leadership of the combined company will reflect the strengths and capabilities of both companies. Upon closing of the transaction, Mr. Bird will serve as Chief Executive Officer of the combined company; Marne Jones, Black Hills Senior Vice President and Chief Utility Officer, will serve as Chief Operating Officer; Crystal Lail, NorthWestern Chief Financial Officer, will serve as Chief Financial Officer; and Kimberly Nooney, Black Hills Senior Vice President and Chief Financial Officer, will serve as Chief Integration Officer. Linn Evans will continue serving as Chief Executive Officer of Black Hills through the close of the transaction, at which point he will retire.

The combined company will be headquartered in Rapid City, South Dakota, and will maintain a strong operational and leadership presence throughout the combined service territory, consistent with the practices of the companies prior to closing.

The combined company will have a new name and ticker symbol, to be determined prior to the close of the transaction. The operating companies are expected to maintain their current names at transaction closing.

The transaction is expected to close in 12 to 15 months, subject to customary closing conditions, clearance under the Hart-Scott Rodino Act, approval from each company's shareholders, and regulatory approvals, including approval from commissions in the three states in which both companies operate (Montana, Nebraska, South Dakota) and in Arkansas if required, as well as the Federal Energy Regulatory Commission.

Goldman Sachs & Co. LLC is serving as exclusive financial advisor to Black Hills, and Faegre Drinker Biddle & Reath LLP is serving as legal advisor.

Greenhill, a Mizuho affiliate, is serving as exclusive financial advisor to NorthWestern, and Morgan, Lewis & Bockius LLP is serving as legal advisor.

Black Hills and NorthWestern will hold a joint investor conference call and webcast today at 6:30 a.m. MDT / 7:30 a.m. CDT / 8:30 a.m. EDT to discuss the transaction.

To participate by phone and ask a question during the live broadcast, participants can access the event directly at Black Hills and NorthWestern Conference Call. Please allow at least five minutes to register. Upon registration, dial-in information will be provided, including a personal identification number.

To access a listen-only webcast and view presentation slides, please register at Black Hills and NorthWestern Webcast. At the conclusion of the call, a replay of the broadcast will be available at this link and at Black Hills’ and NorthWestern’s investor relations websites for up to one year.

The live broadcast and associated presentation materials will be available on the investor relations section of each company’s website at ir.blackhillscorp.com and northwesternenergy.com/investors, as well as at www.BlackHillsNorthWesternBetterTogether.com, a new joint website dedicated to the merger.

Black Hills Corp. (NYSE: BKH) is a customer-focused, growth-oriented utility company with a tradition of improving life with energy and a vision to be the energy partner of choice. Based in Rapid City, South Dakota, the company serves 1.35 million natural gas and electric utility customers in eight states: Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota and Wyoming. More information is available at www.blackhillscorp.com, www.blackhillscorp.com/corporateresponsibility and www.blackhillsenergy.com.

Several of Black Hills Corp.'s subsidiaries do business as Black Hills Energy. As this trade name is the commonly recognized name by many of our customers and shareholders, Black Hills Energy and Black Hills Corp. are used interchangeably throughout communications with respect to the merger for ease of reference.

About NorthWestern Energy - Delivering a Bright Future

NorthWestern Energy Group, Inc., doing business as NorthWestern Energy, provides essential energy infrastructure and valuable services that enrich lives and empower communities while serving as long-term partners to our customers and communities. We work to deliver safe, reliable, and innovative energy solutions that create value for customers, communities, employees, and investors. We do this by providing low-cost and reliable service performed by highly-adaptable and skilled employees. We provide electricity and / or natural gas to approximately 800,000 customers in Montana, South Dakota, Nebraska, and Yellowstone National Park. Our operations in Montana and Yellowstone National Park are conducted through our subsidiary, NW Corp, and our operations in South Dakota and Nebraska are conducted through our subsidiary, NWE Public Service. We have provided service in South Dakota and Nebraska since 1923 and in Montana since 2002.

Forward Looking Statements

Information in this communication, other than statements of historical facts, may constitute forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about the benefits of the proposed transaction between Black Hills and NorthWestern Energy, including future financial and operating results (including the anticipated impact of the transaction on Black Hills’ and NorthWestern Energy’s respective earnings), statements related to the expected timing of the completion of the transaction, the plans, objectives, expectations and intentions of either company or of the combined company following the merger, anticipated future results of either company or of the combined company following the merger, the anticipated benefits and strategic and financial rationale of the merger, including estimated rate bases, investment opportunities, cash flows and capital expenditure rates and other statements that are not historical facts. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “targets,” “scheduled,” “plans,” “intends,” “goal,” “anticipates,” “expects,” “believes,” “forecasts,” “outlook,” “estimates,” “potential,” or “continue” or negatives of such terms or other comparable terminology. The forward-looking statements are based on Black Hills and NorthWestern Energy’s current expectations, plans and estimates. Black Hills and NorthWestern Energy believe these assumptions to be reasonable, but there is no assurance that they will prove to be accurate.

All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Black Hills or NorthWestern Energy to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk of delays in consummating the potential transaction, including as a result of required regulatory and shareholder approvals, which may not be obtained on the expected timeline, or at all, (2) the risk of any event, change or other circumstance that could give rise to the termination of the merger agreement, (3) the risk that required regulatory approvals are subject to conditions not anticipated by Black Hills and NorthWestern Energy, (4) the possibility that any of the anticipated benefits and projected synergies of the potential transaction will not be realized or will not be realized within the expected time period, (5) disruption to the parties’ businesses as a result of the announcement and pendency of the transaction, including potential distraction of management from current plans and operations of Black Hills or NorthWestern Energy and the ability of Black Hills or NorthWestern Energy to retain and hire key personnel, (6) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the transaction, (7) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (8) the outcome of any legal or regulatory proceedings that may be instituted against Black Hills or NorthWestern Energy related to the merger agreement or the transaction, (9) the risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (10) legislative, regulatory, political, market, economic and other conditions, developments and uncertainties affecting Black Hills’ or NorthWestern Energy’s businesses; (11) the evolving legal, regulatory and tax regimes under which Black Hills and NorthWestern Energy operate; (12) restrictions during the pendency of the proposed transaction that may impact Black Hills’ or NorthWestern Energy’s ability to pursue certain business opportunities or strategic transactions; and (13) unpredictability and severity of catastrophic events, including, but not limited to, extreme weather, natural disasters, acts of terrorism or outbreak of war or hostilities, as well as Black Hills’ and NorthWestern Energy’s response to any of the aforementioned factors.

Additional factors which could affect future results of Black Hills and NorthWestern Energy can be found in Black Hills’ Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and NorthWestern Energy’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at http://www.sec.gov. Black Hills and NorthWestern Energy disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws.

No Offer or Solicitation

This document is for informational purposes only and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Important Information and Where to Find It

Before making any voting or investment decision, investors and security holders of Black Hills and NorthWestern Energy are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto (and any other documents filed with the SEC in connection with the transaction) because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described above.

Participants in Solicitation

3, 4 or 5 filed with the SEC. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant documents regarding the proposed transaction filed with the SEC when they become available.

Media -

888-242-3969

Investors -

investorrelations@blackhillscorp.com

NorthWestern Energy Contacts:

Travis Meyer

(605) 978-2967